When ‘Frenemies’ Turn Associates

Written by Bhanu Rekha 27 Apr, 2017

The technology landscape is rapidly evolving, and client expectations are keeping in pace. A company that constantly strives to live up to those expectations has innovation as its bedrock, industry best practices as its brick and mortar, and is persistent on improvements to make sure it leads the change. To meet its ambitious 2020 goals and lead the change, Cyient has redefined its business, identified growth engines, and based its aspirations around an S3 strategy of offering a strong and evolving mix of ‘services, systems, and solutions’ to clients across industries.

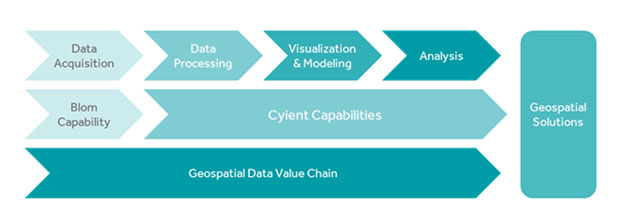

In line with this corporate blueprint, Cyient has evolved an operational strategy at the beginning of FY ’17 within the Utilities & Geospatial (U&G) Business Unit to harness its vast data capabilities. The idea was to move from data-led approach to a solution-led approach and deliver solutions underpinned by full life cycle capabilities. This prompted Cyient to acquire geospatial data sensing capabilities to complement its competencies in data processing, modeling, visualization, and analysis, that it progressively built over the years.

During the spring of 2016, the NRC Group started looking for a potential buyer for Blom Aerofilms, a relatively small and autonomous company within the group. Blom Aerofilms specializes in aerial and land-based data acquisition (optical and LiDAR) and data processing. Prima facie, this made Blom Aerofilms a strategic fit for Cyient to complete the geospatial data value chain. However, the companies have historically been competing, especially in the European market and there have been occasions where Blom services either extended or overlapped with Cyient services.

'Frenemies'-turned-Associates

While organizations take on the competition every day, in a rapidly evolving ecosystem where business value is paramount, there are no permanent competitors/enemies. The Cyient-Blom Aerofilms story is one such transformed relationship. “I would like to call Cyient a ‘frenemy’ – a friend and an enemy. We competed against Cyient. Both the companies provided services to national mapping organizations like the Ordnance Survey. But most recently, Cyient was a supplier to Blom on a very large and complicated project,” says Paul Evans, Managing Director, Blom Aerofilms.

Cultural differences can often create confusion in establishing and managing cross-border partnerships. However, the Cyient-Blom relationship evolved from being competitors into partners and friends. Blom worked closely with Cyient on a project during 2015-16, which involved several visits to India to support the production team there and a few visits the other way around to establish a good production flow for the project. The companies discovered a good cultural fit between them and their work ethics were quite similar. The desire to innovate, and work hard to deliver to match client specifications came through very strongly during that collaboration. They got to know and respect each other while working on the project. This partnership potentially became the beginning of Cyient showing an interest in acquiring Blom Aerofilms.

Value-creating Synergies

With a century-old heritage of aerial photography starting during the World War I, Aerofilms, as it was initially called, later became a land-surveying company. Over the years it adopted new technologies, innovating with the capturing and processing of oblique imagery and LiDAR data and gained reputation of delivering quality mapping services to several UK government agencies. On the other hand, Cyient is an Indian company with a global footprint. Cyient created a brand of its own in engineering, networks and operations, and geospatial solutions and built its capacities over the past 25 years. Cyient-like corporates, growing at a fast pace, focus on creating value through mergers and acquisitions. However, one of the key challenges encountered M&A is estimating the potential value-creating synergies. “At Cyient, we are proud of our geospatial capabilities around software and data processing,” says John Renard, President - Utilities & Geospatial BU & President EMEA. “Blom Aerofilms complements these skills and brings us industry-leading knowledge around data acquisition. We believe that by combining Blom Aerofilms with Cyient’s geospatial business, Cyient is well-positioned as a complete service provider covering acquisition, modeling, and processing services,” he says.

Caption: Cyient & Blom Aerofilms' capabilities across geospatial data value chain

During project interactions, Blom team also discovered that Cyient is a substantial organization with a wide range of skillsets with its footprint in 11 industry verticals. While evaluating the potential partnership/acquisition, Blom Aerofilms had certainly seen an opportunity to put their complementing strengths to a wider benefit. “The whole sale process was done through an M&A consulting firm. We had several interested parties, but the preferred option, certainly from my perspective and from NRC’s perspective, was Cyient from an early stage. The impression was that the merger would benefit and help the company to grow,” says Paul. That confidence got Cyient to sign a definitive agreement to acquire 100% shares of Blom Aerofilms in November 2016.

The direct impact of Blom Aerofilms' acquisition on Cyient's business is immediate and is being felt in the UK and Western Europe. This acquisition also adds to Cyient's capabilities in understanding data acquisition landscape globally and in bidding for projects that involve data acquisition.

Global Impact on Cyient Business

The direct impact of Blom Aerofilms’ acquisition on Cyient’s business is immediate and is being felt in the UK and Western Europe. This acquisition also brings confidence to Cyient in understanding data acquisition landscape globally and in bidding for projects that involve data acquisition.

The hardest part of M&A, which determines the ROI and value to the customer, lies in post-M&A integration. The key lies in leveraging the perceived advantages and work out the fine details. After the completion of the acquisition in late 2016, Blom Aerofilms is now branded as Cyient Aerofilms and is fully integrated with Cyient Europe Ltd, as a 100% subsidiary.

Post-acquisition, the company started (re)aligning its services, looking at and improving the joint company’s solution offerings in the geospatial area and coming up with joint propositions to the market. Cyient is leveraging its marketing and communications strengths to position Blom Aerofilms as a Cyient company and making sure its new and improved capabilities are known within their client base and to the larger geospatial industry, utilities, telecommunications, and transportation markets.

These measures will position the joint company in a good stead and maximize the value of the acquisition. The Blom Aerofilms acquisition was well thought through and is in line with Cyient’s S3 strategy. Once the integration exercise is complete, the teams are confident that starting from the forthcoming fiscal year, this acquisition will create a positive traction for Cyient business.

.png?width=774&height=812&name=Master%20final%201%20(1).png)