Intelligent Engineering

Our Intelligent Engineering solutions across products, plant and networks, combine our engineering expertise with advanced technologies to enable digital engineering & operations, develop autonomous products & platforms, and build sustainable energy and infrastructure

.png?width=774&height=812&name=Master%20final%201%20(1).png)

Making M&A Work in the Fiber Broadband IndustryThe right approach helps harmonize heterogenous fiber networks and systems

CyientMaking M&A Work in the Fiber Broadband IndustryThe right approach helps harmonize heterogenous fiber networks and systems

Abstract

As the demand for high-speed Internet continues to surge, mergers and acquisitions (M&A) play a pivotal role in shaping the competitive landscape. Building a fiber network from scratch requires substantial investment in both time and resources. In contrast, acquiring existing fiber infrastructures allows companies to rapidly expand their coverage area and gain a larger customer base. However, it also presents inherent challenges and risks. In this white paper we discuss the main challenges organizations face in consolidating fiber operations and share insights and recommendations that can help overcome the challenges of integration complexity.

Introduction

The fiber broadband industry has witnessed significant consolidation through mergers and acquisitions (M&A) driven by technological advancements, regulatory changes, and the pursuit of market dominance.

Fiber broadband’s ability to support bandwidth-intensive applications such as streaming, gaming, and cloud computing has fueled its widespread adoption. As a result, telecommunications companies are increasingly recognizing the strategic importance of expanding their fiber network coverage and offerings.

Building a fiber network from scratch requires substantial investment in both time and resources. In contrast, acquiring existing fiber infrastructures allows companies to rapidly expand their coverage area and gain access to a larger customer base. This approach not only accelerates market penetration but also facilitates economies of scale, thereby reducing operational costs in the long run.

Moreover, M&A transactions in the fiber broadband sector often involve vertical integration strategies aimed at strengthening the overall value chain. For instance, telecommunications companies may acquire regional fiber providers to vertically integrate upstream into wholesale network services or downstream into retail broadband services.

By owning both the infrastructure and the service delivery platforms, companies can exert greater control over pricing, quality of service, and customer experience, enhancing their competitive edge.

Europe is rife with instances of M&A in recent years. CityFibre bought Fiber Nation in 2020, Community Fibre bought Box Broadband in 2021, and Swish Fibre bought People’s Fibre in 2022. 2023 saw a flurry of M&A activity with nexfibre acquiring Upp, Fern Trading bringing together AllPoints Fibre, Giganet, Swish Fiber, and Jurassic Fibre, the Telcom Group acquiring Luminet, Orange Belgium completing the acquisition of VOO SA, Altice acquiring 50% of Vodafone Germany’s FTTH business, and Telenet and Fluvius in Belgium forming a joint venture named Wyre for FTTH expansion.

Access Whitepaper

Roadblocks in Fiber Network Consolidation

While M&A can offer significant benefits in terms of market consolidation and strategic positioning, in our experience at Cyient, we have seen challenges in the following areas:

Network Integration:

Achieving technical compatibility and interoperability between disparate systems can be complex and may require significant investment in design, testing, and upgrading or replacing existing infrastructure. All of this will also need to be done without disrupting customer service, which puts a strain on existing operational teams.

OSS-BSS Integration:

Legacy OSS/BSS systems may have different architectures, data formats, and protocols, making seamless integration challenging. In addition, they may be reaching end-of-life, upgrades may not be financially viable, and new upgrades, namely to cloud native solutions, may be required. Further, migrating data from legacy OSS/BSS systems to a unified platform can be complex and time-consuming. So, data cleansing, transformation, and mapping will be required to ensure the accuracy and consistency of data across the consolidated network.

People and Process Integration:

It is natural that each pre-merge organization will have its own staff and processes. However, aligning disparate processes and workflows from different organizations can be challenging due to differences in organizational culture, practices, and priorities. Achieving consensus on standardized processes and implementing change management initiatives present a complex challenge that will require dedicated effort and sponsorship across all levels in the organization.

Cyient’s Solution Approach

Cyient has been privileged to participate in several post-M&A consultation and implementation opportunities with telecom operators. As examples, we have delivered Passive Network Inventory (PNI) and Logical Network Inventory (LNI) migration and consolidation programs with “zero data loss” assurance. We have implemented field service management and service assurance solutions and developed integrations with other systems. We have performed network migration planning and implemented NOC consolidation. Through this experience we have identified some key network and systems dimensions that operators are required to manage post M&A. These include:

Network consolidation

Although M&As mostly target nonadjacent networks for maximum capital allocation returns, there may be some overlap of multiple ISP and OSP networks in the same region. As an initial step, eliminating this overlap can improve network utilization and reduce OPEX.

Consolidating and harmonizing network technology at all network layers will ultimately yield significant benefits in cost savings, improved efficiencies, better service quality, enhanced security, and faster deployment of new services.

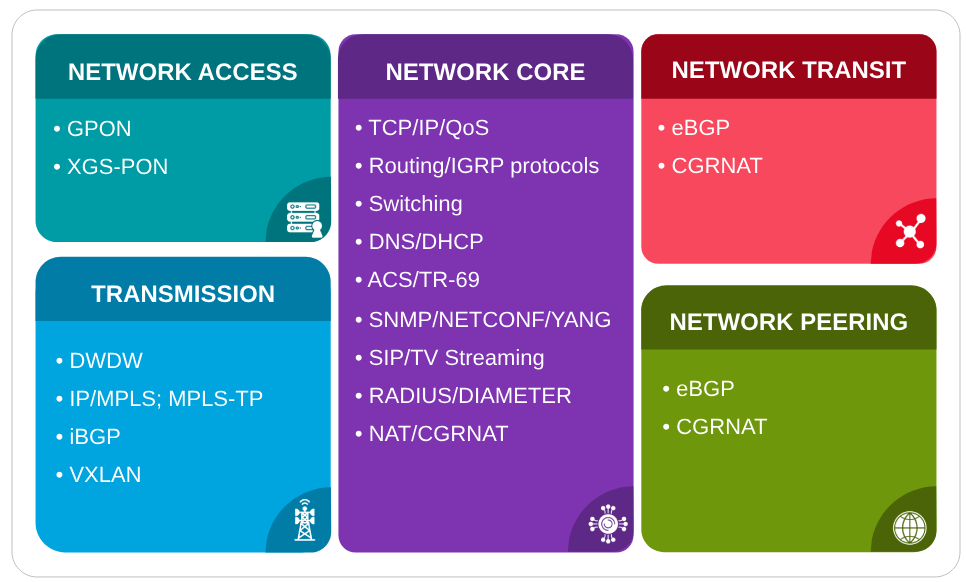

The broad range of technologies deployed under the fiber broadband scope cover the following domains:

Network harmonization requires multiple domain experts as well as architecture design and technical governance to ensure all domains are aligned. Cyient’s approach to a high-level network consolidation methodology is as follows:

Discover

- • Identify current network infrastructure (network elements deployed and area covered)

- • Analyze the current support model and age of network elements

- • Analyze current bandwidth, different services provided, and existing capacity

- • Analyze data sets such as location, system name, network configuration details, and vendor support

Design

- • Define roadmap to migrate the physical and logical connection between network elements

- • Define roadmap to interconnect networks where necessary

- • Define roadmap to consolidate data sets

- • Design integration and upgrade of existing network elements or introduce new ones

Test

- • Create a test plan strategy for interoperability or new network introduction testing

- • Review existing test environment and toolsets

- • Develop test automation capabilities where applicable

- • Develop use cases and POC (proof of concept) plans

- • Perform test uses and deliver reports

- • Manage the defects life cycle

Implement

- • Define implementation plan to minimize network impact

- • Perform network consolidation activities and traffic migration

- • Perform acceptance testing

- • Decommission network elements and services as required

OSS-BSS consolidation

Acquired entities often have different OSS and BSS stacks. Harmonizing them is critical for efficient delivery of services, for maintaining operational efficiency, and for optimizing OPEX. For example, a consolidated physical network inventory, which holds the complete physical network information and customer information, is critical to planning, designing, and operating the network. A careful analysis of the underlying data models needs to be conducted before devising the data migration strategy. Without a consolidated OSS and BSS, network and customer functions are difficult to perform, leading to loss of revenue and customer dissatisfaction.

It is also important to review existing integrations between different systems. Planning an integration layer to facilitate seamless communication and data exchange is a must. In cases of older legacy systems where documentation or architecture knowledge is missing a detailed application architecture audit will be needed. In addition, this stage could be leveraged to transition applications to a cloud-native environment and AI frameworks to bring them up to speed on the latest infrastructure technology.

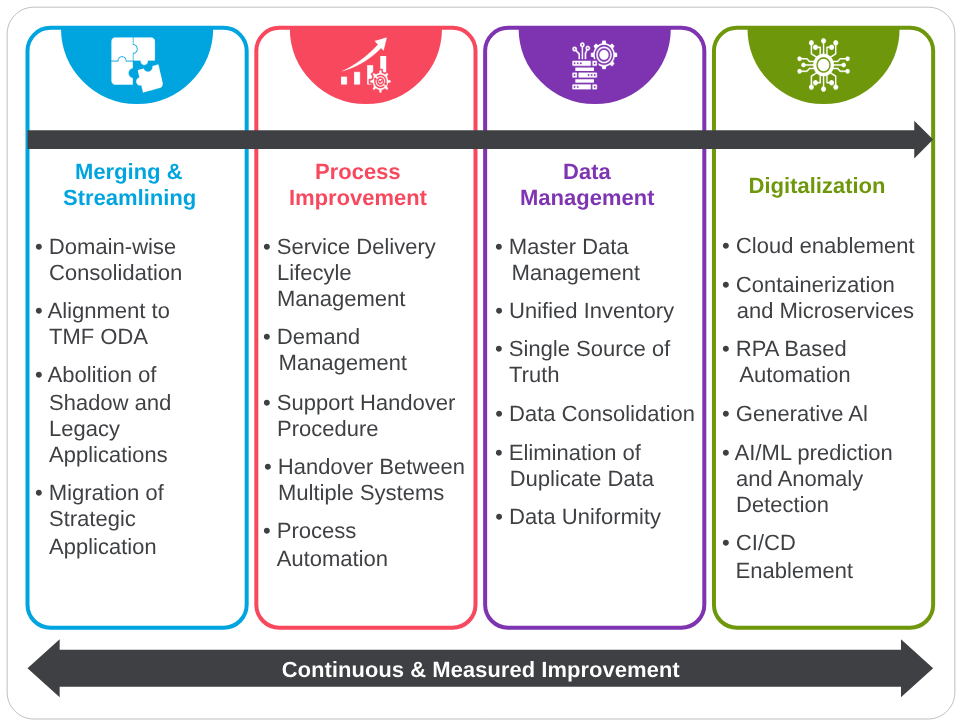

Cyient’s approach to successfully consolidating and transforming OSS/BSS estates is to address the following pillars:

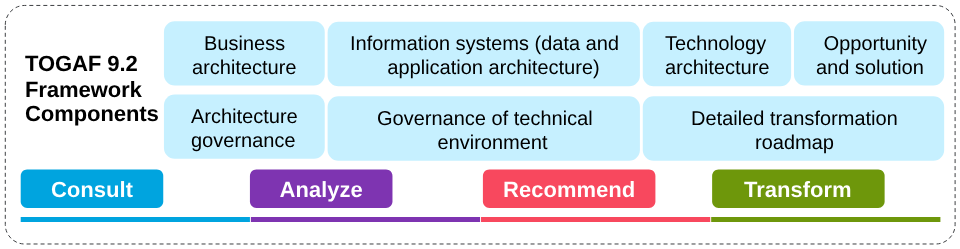

Also, Cyient promotes industry-based methodologies (such as TOGAF) to support customers in their OSS/BSS application consolidation journey, such as the one depicted below.

People and process integration overlayed with automation

An acquired entity might have very different processes. Implementation of a uniform process is critical for consistent service delivery. Likewise, merging teams responsible for the same function generate scale benefits and help implement a common process. One area where consolidation yields tangible benefits is the integration of several NOCs (Network Operation Centers) of multiple entities into a single unified NOC. To do so, an audit of Current Mode of Operations (CMO) processes is typically required to design an efficient Future Mode of Operations (FMO). Below is a sample of the different dimensions and processes Cyient would cover in such a scenario.

Once the people and processes are aligned, it is imperative for an operator to turn to automation. Operators are rapidly embedding automation into their processes as they embark on their journey of being autonomous. However, automation cannot effectively function and deliver results if the systems and processes are not tightly knit and if the systems themselves are not integrated.

An example of the transition and automation transformation journey of an NOC function is shown below

Conclusion

Harmonizing networks and systems post M&A is a complicated endeavor. The success of an M&A largely lies in how effectively these have been harmonized.

This process will need to ensure it can yield financial benefit to investment stakeholders while ensuring zero disruption to end users in the transition stages, and improve customer experience thereafter.

Hence, operators should use due consideration in selecting the right consulting and implementation partner to support them in this complex transformation journey.

About the Author

Pedro Lopes is Head of Networks in the Digital and Technology Advisory group ( DTAG), and reports to the Cyient group CTO. He is responsible for Cyient’s networks portfolio and provides business development advisory to Cyient’s global sales organizations.

About Cyient

Cyient (Estd: 1991, NSE: CYIENT) partners with over 300 customers, including 40% of the top 100 global innovators, to deliver intelligent engineering and technology solutions for a digital, autonomous, and sustainable future. As a company, Cyient is committed to Designing a culturally inclusive, socially responsible, and environmentally sustainable Tomorrow Together with our stakeholders.

For more information, please visit www.cyient.com

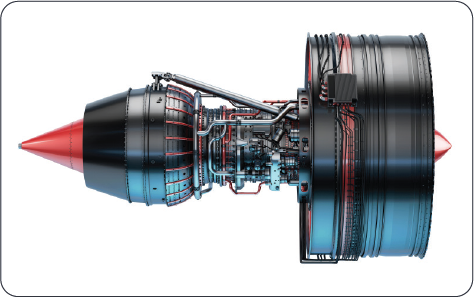

Types of System Loads

Engine loads are classified into normal, limit, and ultimate. Normal loads, like takeoff rotation, occur regularly. Limit loads, like hard landings, are the maximum operational loads. Ultimate loads, like blade off situations, are maximum loads designed to withstand without failure.

Engine Backbone Bending

Engine deflects due to applied loads, known as engine backbone bending, are caused by asymmetry relative to mounts. Loads such as take-off rotation, aerodynamic, inertial, and engine thrust induce this bending, highest during takeoff. Cases and rotors bend differently, affecting aerodynamic efficiency and compressor stability. Design considerations aim to minimize blade tip-to-case closures, ensuring optimal operating efficiency and compressor surge margin.

Cowl Load Sharing (CLS)

CLS acknowledges the structural capacity of the cowl and thrust reverser. If backbone bending exceeds limits, distributing some load to the cowl is a solution, specified as a percentage. Since cowl design is typically separate from the engine, a cowl load sharing percentage is agreed upon, enabling parallel design processes. Nacelle also carries load to minimize engine bending, making cowl load sharing a compromise.

Fan Blade Off

Fan Blade Off (FBO) refers to a fan blade detaching from its root, typically due to material failure, fatigue, or foreign object damage. The FAA mandates engine tests to demonstrate containment without fire or failure for at least 15 seconds. FBO-induced structural loads and vibration may damage nacelles, equipment, mounts, and airframe. Traditionally, these vibratory loads are considered insignificant compared to other design loads.

Wind-Milling and Its Impact

Wind-milling occurs after a fan blade detaches mid-flight, causing the engine to rotate due to incoming airflow, known as “wind-milling imbalance.” This rotation with an asymmetric fan generates large out-of-balance forces, potentially leading to rubs and impacts. Dynamic analyses represent component modes without considering strength and structural endurance.

Engine Design Phase

The design phase of an aero engine is critical, setting the course for the next seven-eight years of development. Disruptions can lead to significant losses. Challenges discussed earlier should guide load management during design. Designs undergo rigorous evaluation for structural analysis, manufacturability, and costing.

Load Analysis, Simulation, and Mitigation

Growing computational power enables optimal solutions for industrial problems. Numerical simulations constructed from FE models predict, and analyze loads in aero-engines, aiding CAD model optimization. Experimental testing validates analytical predictions, reducing costs and saving billions for the aviation industry.

Load Mitigation Strategies

Advanced materials affect engine load bearing. Research uses exotic materials in aeroengines to reduce weight without compromising performance. Active load control systems adapt technologies for load mitigation.

Conclusion

A comprehensive understanding of aero engine loads in the context of contemporary aviation is critical, emphasizing the need for continuous research and development to address evolving challenges in the field.

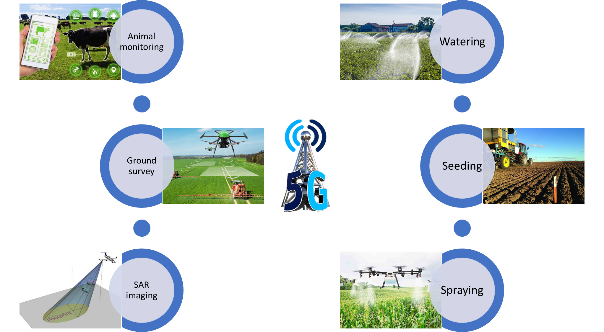

5G technology in agriculture

The advent of 5G technology will revolutionize global farming landscapes and will open up multiple ways to establish and grow precision farming. The figure below shows that every element in modern agriculture once connected to a high speed and high throughput 5G cellular network, works in tandem with the other to optimize resources and maximize yield. The imagery generated from SAR and GPR demand throughput for transferring them to a distant and central location/data cloud. Similarly, to control farming equipment remotely, a low latency communications network in inevitable.

Figure 10. Uses of 5G technology in agriculture

Future of Hyperautomation

Hyperautomation will continue to evolve and redefine industries. Here are a few trends that could shape its future:

Hyperautomation as-a-service

Cloud-based hyperautomation platforms will become more accessible, allowing organizations of all sizes to leverage automation as a service. This democratization of technology will drive innovation across sectors.

Human-automation collaboration

Rather than replacing humans entirely, hyperautomation will focus on enhancing human capabilities.

Industry-specific solutions

Hyperautomation will be tailored to meet the specific needs of different industries. We can expect specialized solutions in sectors like healthcare, manufacturing, telecom, energy, and utilities addressing industry- specific challenges and requirements.

Enhanced cognitive capabilities

Advances in AI, ML, and Gen AI will lead to even more sophisticated cognitive capabilities, enabling systems to handle complex decision-making and problem- solving tasks.

IoT integration

IoT will become more tightly integrated with hyperautomation. Sensors and data from connected devices will be used to optimize and automate processes in real time.

Cross-industry collaboration

Industries will increasingly collaborate and share best practices for hyperautomation implementation. This cross-pollination of ideas will accelerate innovation and adoption.

Regulatory frameworks

Governments and regulatory bodies will establish frameworks to address the ethical and legal implications of hyperautomation, ensuring a responsible and fair use of the technology.

In the future, we can expect to see even more changes in the way hyperautomation is used and implemented. Advances in IoT, blockchain, and quantum computing will open opportunities for hyperautomation to be applied in new domains and enable it to automate highly complex tasks and processes.

About the Author

Vishnu Gaddam, an aerospace professional with Cyient since 2011, brings over 15 years of experience in the field. His journey began at GE Aviation, where he assessed both small and large aero engines for static and dynamic behavior. At Cyient, Vishnu works on complete aero engines and evaluates loads under normal and extreme operational conditions. He is a certified Project Management Professional (PMP), Certified Scrum Master (CSM), and Six Sigma Green Belt. As a subject matter expert, Vishnu collaborates across teams, fostering knowledge exchange.

About Cyient

Cyient (Estd: 1991, NSE: CYIENT) partners with over 300 customers, including 40% of the top 100 global innovators of 2023, to deliver intelligent engineering and technology solutions for creating a digital, autonomous, and sustainable future. As a company, Cyient is committed to designing a culturally inclusive, socially responsible, and environmentally sustainable Tomorrow Together with our stakeholders.

For more information, please visit www.cyient.com