- 2026-Feb-17

The Future Is Software - Part 5 of the ‘Intelligent Automotive Series’

Written by Shashank Kulkarni Jul 8, 2022 2:20:20 PM

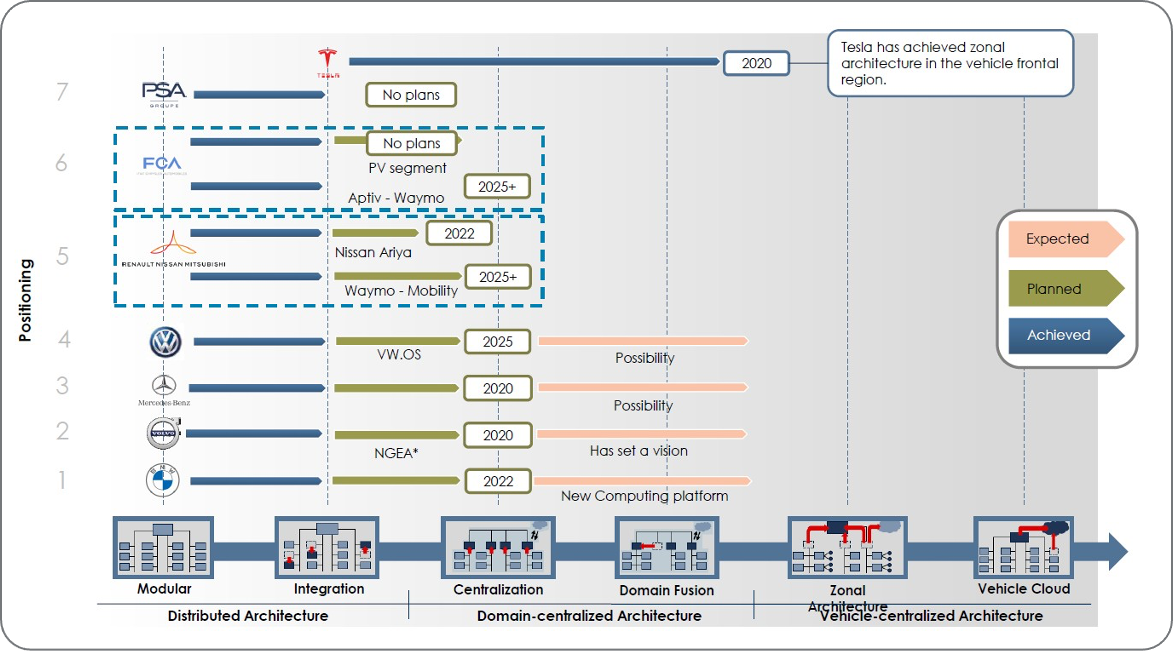

Software-defined innovations will sculpt the future roadmap of the automotive industry. The new-age cars will depend on the centralization of high-performance computing units, breaking away from the traditional distributed architecture approach. In effect, central computing platforms are being designed to power the compute-intensive domains of the car, such as infotainment and autonomous driving.

This shift will allow hardware to be decoupled from software, relieving OEMS from the need to be tied to single suppliers or deal with lengthy development and deployment cycles. Instead, new revenue opportunities will open up by the possibility of upgrading or adapting the capabilities of the car post-purchase.

Previously, these updates belonged to the infotainment or telematics domain of the vehicle. The upgrade to cross-domain, centralized E/E architectures (as demonstrated by Tesla) will allow the ability to also update other critical areas of the car, such as the powertrain or ADAS features. With over-the-air (OTA) software and firmware updates, OEMs can unlock new levels of operational efficiencies such as reducing the number of recalls, lowering warranty costs, and improving customer experience with convenient deployment of the latest features and upgrades.

With their soaring ambitions to win the race to fully autonomous vehicles, premium manufacturers have now realized the need to reduce the complexity and number of ECU signals being sent and received to enable connected functions. The goal is to use fewer, integrated multi-purpose ECUs. The following illustration represents the ongoing development and despite those targets, the amount of ECUs was only increasing, underlining the struggle to achieve this ambitious goal.

Brand Differentiation with Software Offerings

As digitization becomes central to innovation, automakers are realizing the need for investments and partnerships in the cloud computing and connected car segment. This provides the infrastructure for connected features such as navigation, location-based services, and remote vehicle functionality. When combined with state-of-the-art HMI inputs such as virtual personal assistants, wide-screen touchscreens, and gesture control, OEMs can present differentiated infotainment experiences from their competitors, as described below:

As digitization becomes central to innovation, automakers are realizing the need for investments and partnerships in the cloud computing and connected car segment. This provides the infrastructure for connected features such as navigation, location-based services, and remote vehicle functionality. When combined with state-of-the-art HMI inputs such as virtual personal assistants, wide-screen touchscreens, and gesture control, OEMs can present differentiated infotainment experiences from their competitors, as described below:

- Digital Cockpit and IVI Development: Cyient enables automotive OEMs to create engaging In-Vehicle Infotainment (IVI) customisations focused on seamless connectivity, safety, cost effectiveness, and enhanced user experiences.

- Middleware/App Development and OTA readiness: Cyient can facilitate access to critical vehicle data from the controller area network (CAN) in the form of visual and text-based alerts which, in turn, can aid in the experience of navigation and other location-based services. It can also develop and update vehicle software OTA with lean and secure data packages.

- High-end Software Development and ECU Integration: With over 20 years of domain experience, Cyient can develop embedded electronic products, which include web, mobile, and desktop application development—ranging from software validation of ECUs to turnkey central lock and anti-theft modules, reduction in the amount of ECUs and even software calibration of e-drivetrains.

- Testing and Validation: Comprehensive testing assets around hardware-in-the-loop (HiL), model-in-the-loop (MiL) and software-in-the-loop (SiL), Cyient’s own test benches and labs allow for interoperability testing for smartphones, smartwatches, USBs, Wi Fi routers and any other device brought into the car for the purpose of connectivity.

Data and Software - Opportunities and Challenges

With progressing levels of autonomy and consequent rise in the number of sensors and volume of in-vehicle data processing, cars are increasingly being referred to as “data centers on wheels.” As computing complexity increases, autonomous vehicles will create terabytes of data per day that will need to be stored, processed, and analyzed.

The roll-out of 5G and its enablement of faster, less latent V2X communications will ensure those insights from other vehicles, pedestrians, and infrastructure modules are passed to and from the car. It is estimated that from Level 2 ADAS to Level 5 Autonomous Vehicles, the computing complexity rises from 1 TB per day to at least 10 TB a day.

Automakers that can crunch and optimize voluminous data can realize operational benefits such as strengthening R&D programs, managing warranty costs, and running effective customer relationship management campaigns. In addition, OEMs that are able to prioritize ‘data business and strategy’ through focused investments in recruitment and technical assets will open up new revenue streams by commercializing vehicle data for third parties to access. In this way, industries such as insurance, fleet management and advertising can use data to create new services.

These new opportunities must be considered in tandem with the need to be compliant with privacy regulations, robust with cybersecurity practices, and cognizant of consumer-centric approaches to vehicle data. Automakers will have to look at credible solutions to manage data related challenges:

- Data Security and Data Handling Expertise: With specialization in first-time-right (FTR) functional designs and automotive safety, Cyient can assist clients globally with hassle-free, cost-effective services backed by its exceptional concept-to-production solutions. For instance, Cyient’s IoT Edge Gateway 5400, certified by Azure, allows OTA updates and Edge Analytics.

- Analytics Framework: Cyient helps create actionable insights by leveraging business-owned data pools and connecting it with customers, operations, and suppliers. In this manner, data is put to use for internal and external benefits. Using its expertise in semiconductor design services and AI technologies, Cyient is able to create IVI systems that perform intelligent processes according to the context of the vehicle.

- Platform Agnostic Development and Integration: For end-to-end digital transformation or a targeted solution, Cyient solves problems from the edge to the cloud for platform-agnostic business insights that impact outcomes. This means that savings of up to 30% in development costs can be achieved.

Autonomous On the Rise

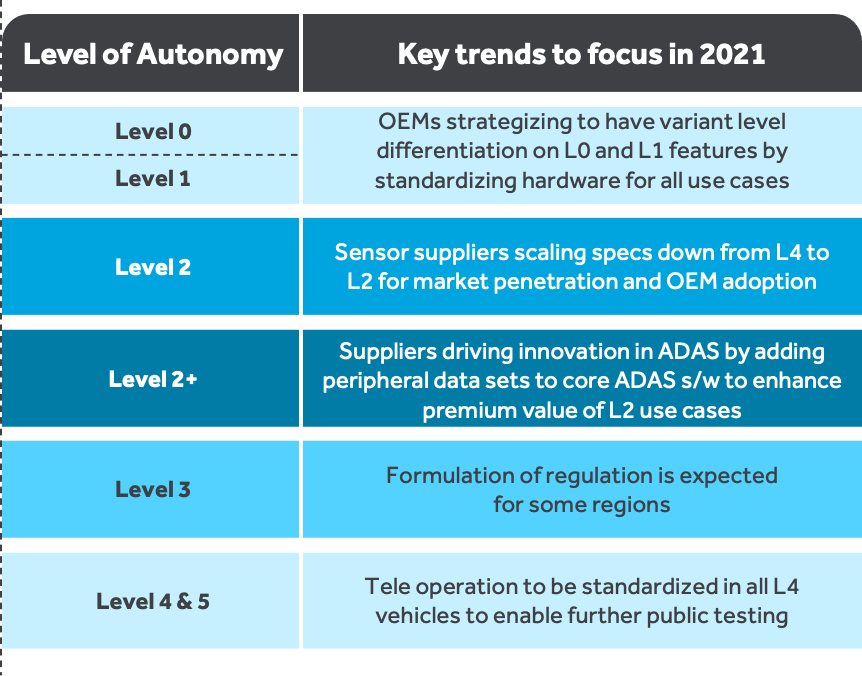

Following a period of heightened R&D investment and bold roadmaps for Automated Driving (AD) deployment across personal and commercial transport, the global autonomous vehicles market is now undergoing a recalibration phase. By the end of the decade, one in four vehicles is expected to have autonomous features with use cases spanning the transportation spectrum from driverless, city-dwelling taxi fleets to long-distance autonomous trucks.

AD represents a huge opportunity to transform mobility, with improvements like heightened safety, better efficiencies, and enhanced convenience. Tech talent will be needed to tackle the plethora of new technologies required to scale autonomy in a sustainable way. Some of the challenges in the way of these new technology frontiers are:

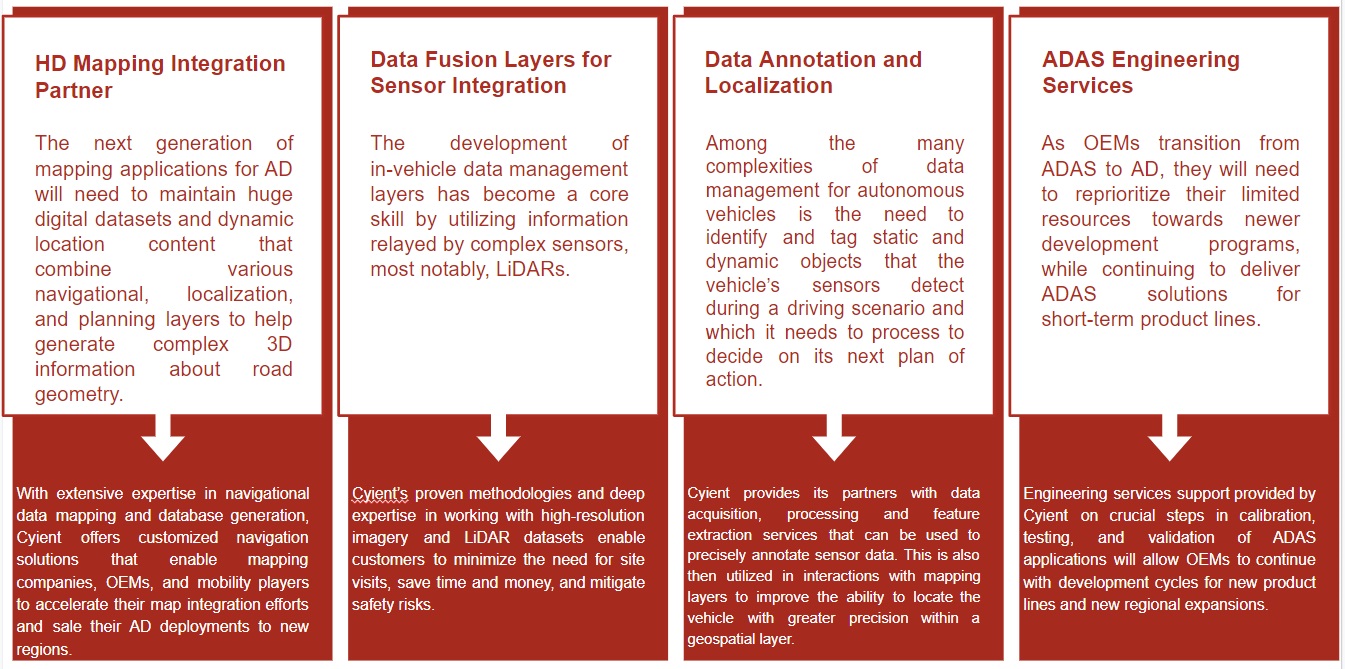

- High definition mapping, perception sensors, and high-compute chipsets, unconventional to the automotive ecosystem;

- Data utilization for providing end-to-end customer-centric use cases; and

- Cloud-based services that enable functionalities such as data integration, data utilization, and location intelligence

Addressing these new technologies while transitioning from the current business of providing ADAS further pressurizes the resources allocated for this transformation.

Supporting ADAS for an Autonomous Tomorrow

Conclusion

The uniqueness of future offerings will be decided by software-centric features, comprehensive semiconductor designs, and advanced digital platforms. Transformational costs are skyrocketing. R&D spending on electrification is outstripping budgets for regular R&D, emphasizing the need for a careful reconsideration of resource allocations. For any new challenge, be it Industry 4.0, machine learning, circular economy or customer centricity, automotive leaders will have to forge a strategic partnership with digital disruptors to equip themselves with the right capabilities at the right time.

We conclude the ‘Intelligent Automotive Series’ with this part. Do share your valuable thoughts and feedback in the comment section (scroll down). If you would like us to explore some other trends in the automotive space or other industries, do let us know.

### References: Figures and illustrations are developed with and by Frost & Sullivan, e.g. the MG08- Global Automotive Outlook 2021 report.

.png?width=774&height=812&name=Master%20final%201%20(1).png)