Responding to the Evolving Customer and Supply Chain Demands in the Aerospace and Defense Industry

Written by John Kenkel 06 May, 2020

The ongoing COVID-19 pandemic has caused an unprecedented amount of turbulence in the global aerospace and defense (A&D) industry. What differentiates this scenario from earlier crises such as 9/11, the SARS outbreak of 2003, and the Great Recession of 2008, is the sharp fall in aircraft deliveries accompanied by growing pressure on the supply chain. Additionally, liquidity issues due to revenue losses and cost savings initiatives due to lockdowns could further exacerbate the situation in the months and years to come.

Impact on Various Segments

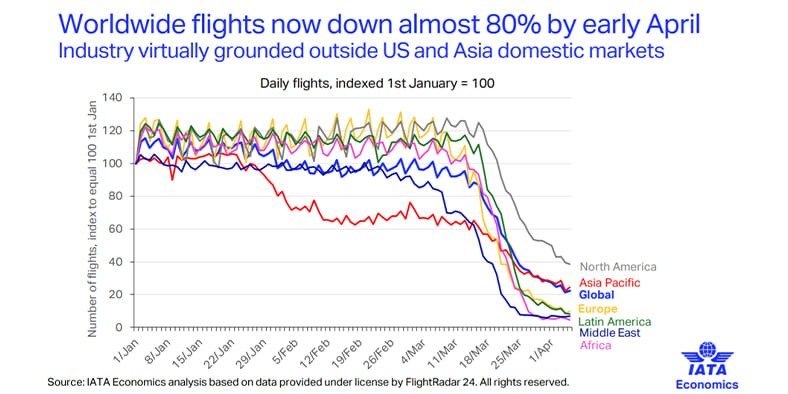

According to a recent IATA report, the number of worldwide flights has dropped by 80% since the beginning of this year with most markets, except North America and pockets in the Asia Pacific, registering near zero traffic. And with projections for 2020 predicting a drop of 55% in passenger revenues compared to 2019, a cascading effect on OEMs and their suppliers due to deferred or canceled orders is imminent. This is further complicated by the restrictions on the mobility of people and supplies.

The effect on OEMs and the supply chain has been significant. Oliver Wyman has estimated that aircraft production will decline by half, with 2020 rates falling from 1,780 to 935 aircraft, with the possibility of additional cuts. As a result, both Boeing and Airbus have announced plans for large scale layoffs to preserve cash. This will result in a reduced capacity requirement in the supply chain by up to 50%, according to industry analysts. To add to the challenge, the airline industry will require an additional $200 billion in stimulus to keep many firms in business. The pressure on the market is unprecedented.

In terms of MRO and aftermarket services, grounded fleets are being serviced and maintained by the airlines themselves rather than flying them to MRO facilities for repair and maintenance. Demand for MRO will be particularly hard hit with flights significantly down and the need for repairs limited. Initially, there was some expectation that airlines may have used the groundings to undertake needed repairs and upgrades. However, that has not panned out as airlines are desperate to preserve cash and are awaiting additional government stimulus to keep solvent. Not only are airlines parking aircraft to wait out the decline, but they are putting some in long-term storage in anticipation of an extended decline in demand.

On the other hand, the demand from the defense segment is likely to remain stable at least over the next 12 and possibly 24 months. Defense work has been deemed critical by almost every nation, and governments are using defense contracts and funding to stimulate the economy. In addition to being long-term, strategic contracts, the engagement between customers (governments), and their contractors is a lot deeper, which provides vendors an extra layer of protection against such shocks. However, as suppliers and vendors look to offset their losses from the commercial segment, they are likely to gravitate toward defense applications, which could increase competition in the market. The real challenge lies in the medium to long term for firms with defense exposure. With government tax revenues on the decline and historic levels of government money being spent to stimulate the economy, the ability to fund any discretionary funding (which includes defense) will face challenges in the next several budget cycles, and we are already seeing budget pressure in some APAC nations. So while defense exposure will provide a near term hedge, that safety will not be permanent.

Transition to Industry 4.0

As players within the A&D ecosystem deploy and improvise their BCPs, a key challenge in the immediate term will be to reduce costs and do more with fewer resources. This includes improving efficiencies on the shop floor, ushering in a new era of remote working and collaboration, and, most importantly, ensuring productivity and reliability in a new work environment.

Advances in defense applications and plateauing demand in commercial aviation over the last couple of years have triggered tremendous interest in Industry 4.0 within the A&D ecosystem. This includes artificial intelligence and analytics for decision-making, digital twins and collaboration tools for design, machine learning and robotics for enhanced production, as well as optimization tools for strengthening the supply chain. According to a report, A&D enterprises undergo digital transformation at three levels; see graphic below.

However, while this sounds like an ideal use case for deploying digital tools and emerging technologies, the uncertainties in the present scenario have reduced the appetite for risks within the industry. As a result, OEMs are averse to adopting unfamiliar or untested solutions and are only interested in digitalization that delivers immediate impact, and where benefits have been proven. In such a scenario, the key for suppliers and vendors lies in establishing a sense of trust and highlighting the financial value of digital technology by showcasing its use case (internally or externally) and by communicating the quantifiable impact of those implementations.

Proactive Supply Chain Management

The global restrictions on transport and production have hit the A&D industry hard. With geographically distributed supply chains, several OEMs and suppliers are down to a few weeks of supplies and critical components. The situation is further complicated by constricted financial liquidity, which has resulted in OEMs making additional demands on their suppliers in the form of delayed payment schedules, cost reductions, and increased desire for risk-sharing. This uncertainty has resulted in hiring furloughs, layoffs, and according to analysts, if this continues, it could lead to several smaller vendors closing operations for good.

A key outcome of this crisis will be a paradigm shift in supply chain management from being a part of cost management to becoming a more strategic and mission-critical function. OEMs will look for proactive supply chain management strategies that ensure continued production and serviceability for their end customers. Additionally, this scenario also offers an opportunity for vendors who can enhance the existing supply chain of OEMs either through cost optimization or by providing an alternate source for procuring critical supplies. In fact, we are already seeing government support and funding to move supply out of China. So, while initial uptick could be slow, suppliers that can promise stability in an OEM’s supply chain in the current scenario could become valued partners in the long term.

A Turbulent Transition

With both announced and expected layoffs, the A&D industry will lose tens of thousands of skilled workers. Boeing and Airbus alone have already suggested paring back their workforce by nearly 30,000 people, and that will cause a cascade down the supply chain as others have and will follow suit. Such a considerable reduction in the workforce will inevitably lead to instability, despite a drop in demand, as firms grapple with transitioning to a vastly smaller workforce. Skill shortages, facility consolidation, workflow processes, and a decline in institutional knowledge will all be huge issues that firms will need to grapple with over the next year or two. Such massive decreases in staff levels may be necessary from an economic perspective, but the shock of such a significant and rapid reduction will present massive challenges to maintain operational efficiencies and stable supplies of goods and services. These firms will rely on transitioning from labor-intensive operations to leaner strategies and will need to invest capital in digital and automation tools in a way that they never have before. Despite much smaller demand, the need for consistency and protecting margins will be more critical than ever. The risk of disruption and the need to protect revenue and cash flow will necessitate some investments to smooth out the transition and mitigate risk from a very high-risk process. Finding the right balance and tools to walk this tightrope may be the difference between a viable and nonviable business over the next year. The stakes couldn’t be higher.

The Need for Win-Win Solutions

The financial squeeze on all players within the A&D ecosystem could cause OEMs and operators to become apprehensive, particularly those in the commercial aerospace space, which is hit the hardest. With new orders and MRO schedules getting deferred and canceled, suppliers and vendors have to bear the brunt of this meltdown. So, besides the need to manage their costs to stay afloat, their ability to provide proactive solutions and innovative revenue models will determine the survivability of many players across the A&D value chain.

As the supply chain for products moves from just-in-time to a more secure and proactive approach to inventory, service providers too can look at offering reduced rates in exchange for guaranteed contracts with longer durations. This is a win-win situation for everyone involved. For customers, it would provide immediate savings and reduced outflow of cash. For suppliers, it would ensure a consistent revenue stream over a prolonged period, which would help them survive the immediate crisis and undertake the road to recovery.

As the effects of the pandemic become evident within the global A&D ecosystem, there is an unprecedented need for all players to show resilience and intelligence to be able to “live to fight another day.” With digital tools, automation, and emerging technologies at its disposal, the A&D industry will no longer view the capabilities as an enhancement, or something for the future, but as critical to maintaining efficient operations. So, as we work through and begin to look beyond the COVID-19 horizon it is our collective ability to adapt and respond to the evolving customer demands and supply chain dynamics that will determine what the future looks like, and that will be very different to what we have seen in the past. What industry has always seen as solutions to enable the world of tomorrow, will now be an integral part of how we deal with and emerge from this downturn.

.png?width=774&height=812&name=Master%20final%201%20(1).png)